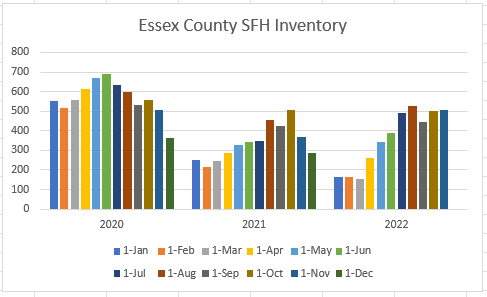

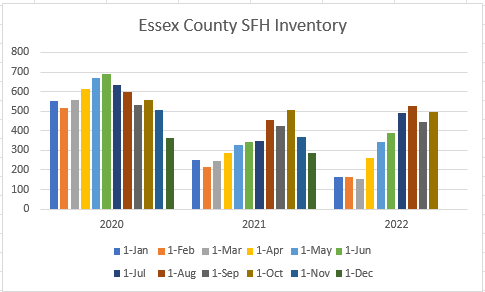

November Inventory stays high

Inventory numbers usually drop as we head towards the winter months, but this year the level of SFH inventory has remained steady so far.

Single Family Homes

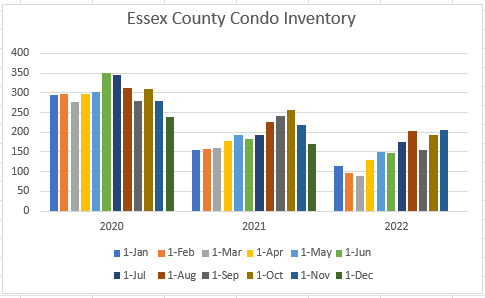

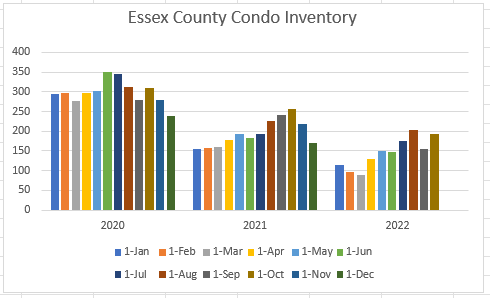

Condos

Condo inventory has also been steady, although this brings the level back only close to last year’s level.

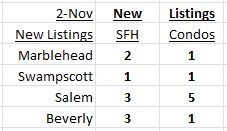

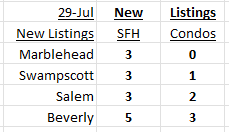

New Listings after Halloween

New Listings mid-week November 2:

Click on these links details: (more…)

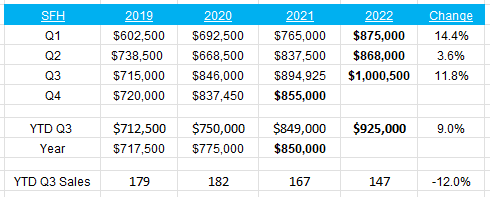

Marblehead Q3 2022 Report: Median Price tops $1 million

The median price of the Single Family Homes (SFH) sold in Marblehead in the Third Quarter (Q3 2022) topped $1 million for the first time, while for the first 9 months of 2022 (YTD Q3) it increased to $925,000. The median condo price increased 7% YTD Q3 to $552,000.

Single Family Homes (SFH)

The median price of the SFHs sold in Marblehead in the first 9 months of 2022 (YTD Q3 2022) increased 9% to $925,000 on the smallest number of sales since 2011.

As the percentage of sales over $1 million increased from 34% YTD in 2021 to 44% YTD in 2022, so the median price moved closer to $1 million – and in fact exceeded that figure in Q3. Sales over $1 million YTD increased from 56 to 66, with 14 sales over $2 million vs 12 YTD in 2021. (more…)

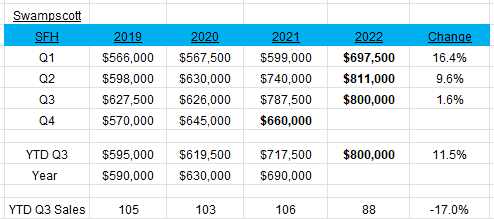

Swampscott Q3 2022 Report: Median Price hits $800,000

The median price of the Single Family Homes (SFH) sold in Swampscott in the first 9 months of 2022 (YTD Q3) increased 12% to $800,000. The median condo price also increased 12% YTD Q3 to $447,500.

Single Family Homes (SFH)

The median price of the SFHs sold in Swampscott in the first 9 months of 2022 (YTD Q3 2022) increased 12% to $800,000 on the smallest number of sales since 2012.

As the percentage of sales over $800,000 increased from 36% YTD in 2021 to 51% YTD in 2022, so the median price moved from just over $700,000 to $800,000. Sales over $1 million YTD increased from 13 to 25. (more…)

October Inventory shows modest decline

After 5 months when Single Family inventory ran ahead of last year’s numbers, in October there was a modest year-on-year drop.

Single Family Homes

Condos

Condo inventory continues to lag both 2020 and 2021 levels.

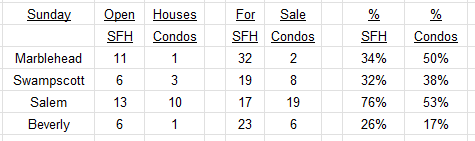

Open Houses Sunday August 28

Here are today’s Open Houses:

Click on these links for details: (more…)

Summer 2022 Market Review

Click on Summer Market Review to read the market review for the first 6 months of 2022,

This reports covers all 34 cities and towns in Essex County, with more detailed reviews of Beverly, Gloucester, Manchester-by-the-Sea, Marblehead, Rockport, Salem and Swampscott

And these recent articles: (more…)

Recession? Yes, no, maybe……..

When I proposed to my wife, she was taken by surprise and responded: “Yes, no, maybe.”

I was reminded of that response while listening to all the conversations in recent days about whether or not the US already in, is about to be in, or will escape a recession.

A lot of the confusion relates to the question: “how do you define recession?” and “who gets to decide if it is a recession?”

And no, it’s not by Punxsutawney Phil looking for his shadow.

What is a recession?

The most common defintion of a recession is two consecutive quarters of negative GDP growth. I used this defintion in my Are we already in a Recession? published on June 18th. This week’s preliminary Q2 GDP number was -0.9% which, following a first quarter print of -1.6%, ticked the GDP box.

If only life were that simple.

Who gets to decide if it is a recession?

Officially, it is the National Bureau of Economic Research’s Business Cycle Dating Committee (I didn’t even know there was such a thing as cycle dating) that declares a recession. In its books, recession is “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.”

Yet the last recession declared by the NBER — for the period from March to April 2020, when the country was hit by the first wave of the COVID-19 pandemic — met only the first half of that definition. It was the shortest recession in U.S. history. Historically, recessions have lasted for 17 months on average.

When will we know if we are in a recession?

The NBER’s Business Cycle Dating Committee takes a cautious approach to its job. It has typically taken the committee four to 21 months to declare a recession. It didn’t declare the recession that began in April 2001 until July 2003.

Are we in a recession?

Fed Chair Powell: “I don’t think it’s likely that the U.S. economy’s in a recession now.”

National Economic Council Director Brian Deese on Thursday argued that although economic growth is slowing, the economy as a whole is showing “extraordinary resilience,” and pointed to the jobs the nation has added in the past year. “We are in a transition, there’s no doubt. The economy is slowing and that is what most expected when coming off of an extremely strong and fast recovery last year. But all of the indications that we see right now are for an economy that’s showing extraordinary resilience in the face of global challenges,

President Biden: “Coming off of last year’s historic economic growth — and regaining all the private sector jobs lost during the pandemic crisis — it’s no surprise that the economy is slowing down as the Federal Reserve acts to bring down inflation.”

“The odds are very high, perhaps over three quarters, that in the next year or two we will have a recession,” says Larry Summers, former Treasury Secretary.

So the answer is…… yes, no, maybe

And these recent articles:

Economic and mortgage commentary

Federal Reserve tries to rewrite history

Has Inflation Peaked?

Have Mortgage Rates peaked?

Are we already in a Recession?

Federal Reserve in Fantasyland: Implications for Housing Market

Time to Consider an Adjustable Rate Mortgage

How Marblehead’s 2022 Property Tax Rate is calculated

Essex County 2022 Property Tax Rates: Town by Town guide

Market Reports

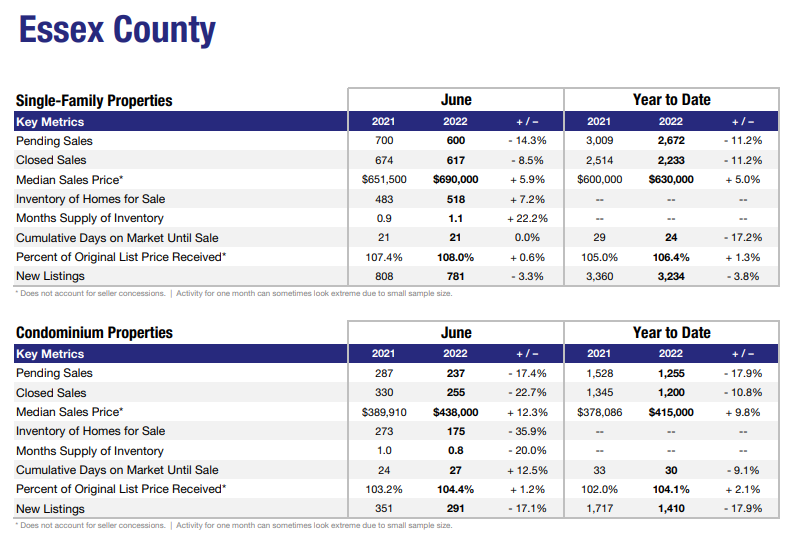

Essex County Mid-Year Market Summary in 5 slides

Massachusetts Mid-Year Market Summary in 5 slides

How quickly are houses selling?

Have Home Sales slowed?

June Housing Inventory: still way below 2020 levels.

Other

Free Property and Mortgage Fraud alert notification for homeowners

Guide to Buying and Selling in Southwest Florida

If you – or somebody you know – are considering buying or selling a home and have questions about the market and/or current home prices, please contact me on 617.834.8205 or [email protected].

Andrew Oliver, M.B.E.,M.B.A.

Market Analyst | Team Harborside | teamharborside.com

REALTOR®

m 617.834.8205

www.OliverReportsMA.com

“If you’re interested in Marblehead, you have to visit the blog of Mr. Andrew Oliver, author and curator of OliverReportsMA.com. He’s assembled the most comprehensive analysis of Essex County we know of with market data and trends going back decades. It’s a great starting point for those looking in the towns of Marblehead, Salem, Beverly, Lynn and Swampscott.”

__________________

Andrew Oliver, M.B.E., M.B.A.

Real Estate Advisor

[email protected]

www.TheFeinsGroup.com

www.OliverReportsFL.com

————

Compass

800 Laurel Oak Drive, Suite 400, Naples, FL 34108

m: 617.834.8205

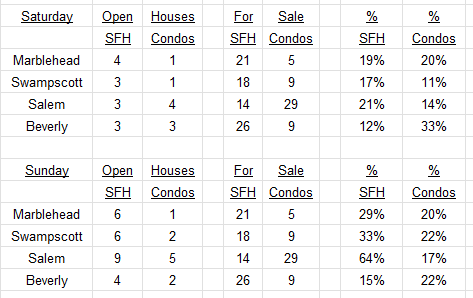

Open Houses weekend July 30/31

Here are this weekend’s Open Houses:

Click on these links for details: (more…)

New Listings and Inventory Update

Here are this week’s New Listings and the latest Inventory:

Click on these links for details: (more…)

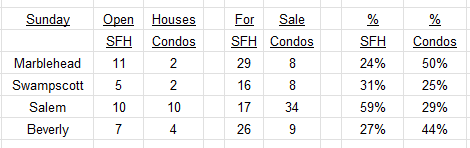

Open Houses Sunday July 24

Here are today’s Open Houses:

Click on these links for details: (more…)

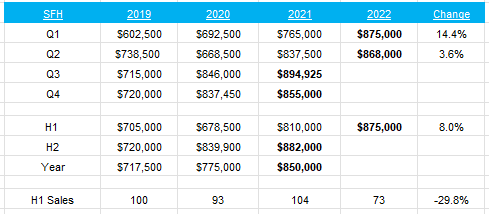

Marblehead Mid-Year Housing Market Report

Single Family Homes (SFH)

The median price of Single Family Homes (SFH) sold in the 6 months to June 30, 2022 (H1) increased 8% to $875,000, while sales, reflecting the reduced inventory, dropped sharply to the lowest number this century, just above the numbers of 2008/09.

Condos

There were 19 condo sales in H1 2022, down from 25 in 2021, while the median price increased 4.1% to $505,000. (more…)

Has Inflation Peaked?

After I published Have Mortgage Rates peaked? last week a reader asked me why I thought the yield on the 10-year Treasury Bill would not continue to increase, so that even if the spread over the 30-year Fixed Rate Mortgage (FRM) narrowed, the FRM rate itself might still increase.

In Are we already in a Recession?, published on June 18, I wrote: “Just as the yield on 10T has more than doubled since pre-COVID while the Fed Funds rate is unchanged, so the Fed Funds rate can increase sharply – the Fed is forecasting it will reach 3.4% this year, also double its pre-COVID level – without necessarily impacting the yield on 10T. That will depend upon the economic outlook. Ironically, perhaps, the more determined the Fed is to drive down inflation – even at the cost of a recession and higher unemployment – the greater the chance that the yield on 10T – and by extension the FRM – will decline – at some point.”

In the last few days, as more economists talked about a recession after the Atlantic Fed updated its Q2 GDP estimate to minus 2.1% (it was 0% when I wrote on June 18), the yield on 10T has dropped sharply, falling to 2.9% from a peak of 3.5% in the middle of May: (more…)

Federal Reserve in Fantasyland: Implications for Housing Market

Immediately following the issuance of the Federal Reserve’s decision on Wednesday to increase the Fed Funds rate by 0.75% and the accompanying, optimistic statement and press conference, both bonds and equities rallied strongly, leading some to think – hope – that the worst was over in markets.

And then came Thursday, when equities resumed their plunge and bonds rallied further – on the belief that a recession was now likely. (See my Are we already in a recession?).

For my part, were it not so serious I would have allowed myself a louder chuckle as I heard Chair Powell say that the Fed would be “data-dependent” – and then forecast that inflation – using the Fed’s preferred measurement – would be 5.2% this year, 2.6% in 2023 and 2.2% in 2023. Based upon what “data” exactly? And what does all this mean for the housing market?

Fantasyland

If you google “Federal Reserve and Fantasyland” you will get a lot of hits. And while many of the comments from Wall Street insiders – particularly those working for investment banks who tend to be optimists – were supportive of the Fed, many of those with perhaps more objectivity were in the fantasyland camp.

The response to COVID

The world’s economy faced a major shock and challenge with the outbreak of COVID. In response the Fed acted swiftly – cutting the Fed Funds rate by 1.5% in two weeks in March 2020 – and with shock and awe – a huge program of Quantitative Easing – injecting vast amounts of liquidity into markets. The Fed became the main buyer of Government and Mortgage-Backed Securities (MBS) and its balance sheet doubled from $4 trillion to over $8 trillion: (more…)

Recent Comments